When it comes to getting a mortgage, there’s no shortage of misinformation. Many homebuyers, especially…

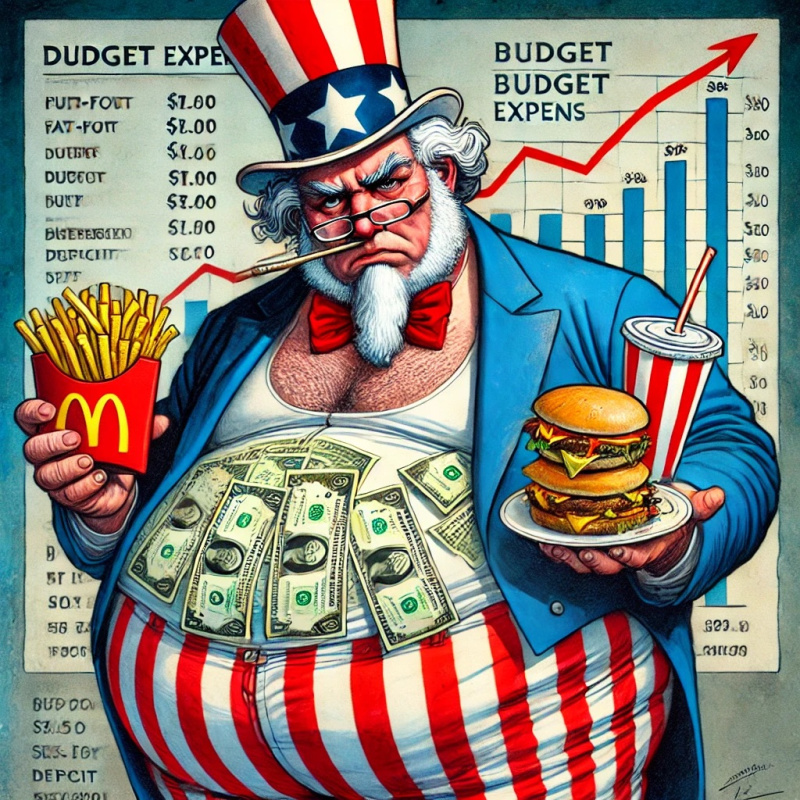

MAGA vs the Deficit Crisis: America’s Financial Obesity Challenge

MAGA vs. the Deficit Crisis, similar to the obesity challenge that affects nearly 75% of U.S. adults, creating a severe health crisis. For those starting a weight loss journey, both physical and mental challenges are overwhelming. Sore muscles, fatigue, and hunger pains are only part of the struggle. The deeper challenge lies in breaking ingrained habits and facing low self-esteem and stress. The process is painful, with frustration setting in when progress seems slow. Despite the difficulty, results often become noticeable within 3-6 months, and the journey continues as a lifestyle change.

Now, let’s look at a similar issue: the U.S. federal budget deficit, which hit $1.8 trillion in 2024. Like obesity, this financial crisis requires tough solutions and painful adjustments. Tax revenue isn’t keeping pace with rising government expenses, much like how a bad diet overwhelms a person’s health efforts. For MAGA vs. the Deficit Crisis a glaring symptom of this financial “obesity” is the Pentagon’s audit failure:

In response, Elon Musk and Vivek Ramaswamy have proposed cutting $2 trillion from federal expenditures, likened to a “Manhattan Project” for government efficiency. Their ambitious plan aims to streamline federal agencies, but it faces political hurdles.

Meanwhile, former President Trump seeks to extend the 2017 Tax Cuts and Jobs Act, potentially reducing corporate tax rates further and eliminating the SALT cap. Both proposals could shake up the U.S. economy, but achieving these cuts will require significant sacrifices.

Economic Impacts to Watch:

- Interest Rates: Budget cuts, reduced deficits and an increase in unemployment may lower inflation, allowing for lower interest rates. The impact of stringent tariffs may actually increase inflation.

- Labor Market: Slashing federal spending should lead to layoffs in public sectors and related industries, increasing unemployment.

- Bankruptcies: Reduced government spending and higher tariffs might push businesses relying on federal contracts into bankruptcy.

- Housing Market: Lower interest rates would be good news for homeowners, with rising bankruptcies and layoffs putting pressure on home prices thus making homes more affordable for home buyers.

- State Impact: States with high federal employment (e.g., Virginia, Maryland) and those relying on SALT deductions (e.g., New York, California) would feel the most pressure from these changes.

The U.S. financial “weight loss” plan for MAGA vs. the Deficit Crisis is like any tough diet, will be painful. But tackling the budget “obesity” may lead to a leaner, more resilient economy in the long term.