When it comes to getting a mortgage, there’s no shortage of misinformation. Many homebuyers, especially…

Understanding Mortgage Rate Trends

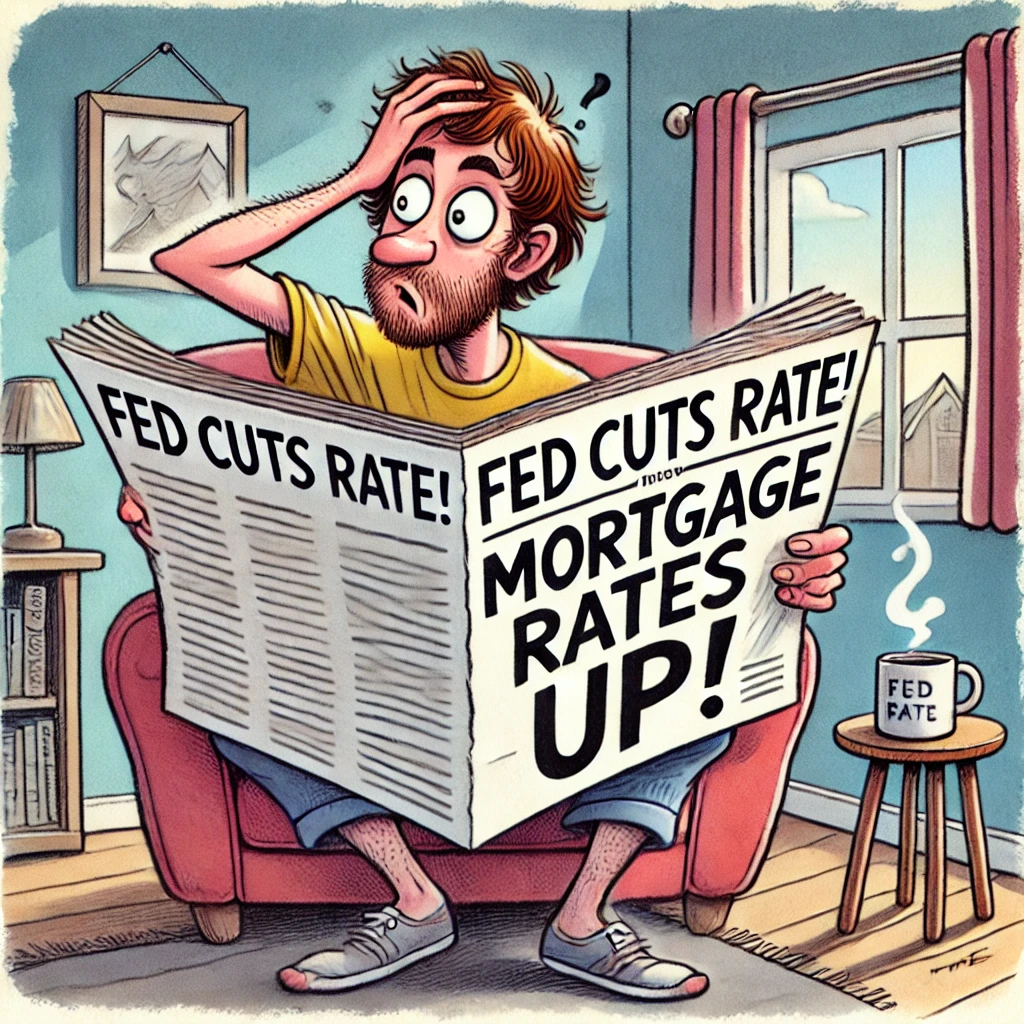

Why Fed Rate Cuts Don’t Always Lower Mortgage Rates

Understanding Mortgage Rate Trends is essential for anyone curious about the housing market. The Federal Reserve has cut rates, but mortgage rates remain stubbornly high. What gives? Let’s break it down.

The Golden Handcuffs Effect

2024 has been a tough year for real estate. Limited inventory and high prices defined the market. Many homeowners are stuck in what experts call “golden handcuffs.”

Their low, pre-pandemic mortgage rates keep them from selling or refinancing. This locks up supply and keeps demand high, which pushes home prices even further.

Why Mortgage Rates Haven’t Followed Fed Cuts

The Federal Reserve began cutting interest rates in September through December 2024. The real estate industry cheered the decision. Yet mortgage rates haven’t dropped alongside them. In fact, the average 30-year fixed mortgage rate is now higher. than it was in September!

This can feel confusing, but here’s the deal: Mortgage rates don’t directly follow Fed rates. Instead, they follow something else – Mortgage-Backed Securities (MBS) and the 10-Year Treasury Yield.

The Role of Mortgage-Backed Securities

Here’s how it works: Mortgage lenders bundle home loans into Mortgage-Backed Securities (MBS). These securities are sold to investors, pension funds, and other institutions.

To measure mortgage rates, we look at the premium over the 10-Year Treasury Bill. Why? The Treasury bill is seen as a “risk-free” investment. In comparison, MBS carry slightly more risk, so investors demand a higher return.

Historically, this premium has ranged from 1.1% to 2%. During the 2008 housing crash, uncertainty pushed the premium to 2%. Today, it’s also at 2%, but for a different reason – demand.

The Fed’s Role in Demand for MBS

The Federal Reserve used to be a massive buyer of MBS. Back in 2010, the Fed owned 12% of the MBS market. By 2022, their share grew to a staggering 30%, worth $2.7 trillion.

Since then, the Fed has pulled back. Today, they own about 25% of the market ($2.25 trillion). Less demand for MBS means investors demand higher returns, keeping mortgage rates high.

Unless the Fed resumes buying MBS in large quantities, mortgage rates are unlikely to drop much further.

What This Means for Your Monthly Payment

While this might seem discouraging, let’s put it into perspective. Here’s how changes in mortgage rates affect a $500,000 conventional loan:

| Change in Mortgage Rate | Monthly Payment Increase |

|---|---|

| 0.25% | $82.65 |

| 0.50% | $166.17 |

| 1.00% | $335.73 |

If rates drop, your savings will be slightly less, but the overall impact is still significant.

The Takeaway

Understanding mortgage rate trends helps borrowers plan ahead. Rates are influenced by many forces – not just the Fed. Keep an eye on Treasury yields, MBS demand, and Fed decisions to anticipate where rates might go next.